Dealers are net long, Leverage Funds are net short, what that means?

For 10 weeks Commercials have been net long, Speculators net short, is this bullish or bearish?

10 weeks ago we posted on Twitter that the weekly COT report showed the Commercials (the Dealer/Intermediary group) were net long after a long time of being short.

The first shift toward net long positions appeared in the June 17 report, just in the week when the market made its lows for the year. Then, in subsequent reports, as the market rallied, this net long position has been increasing.

At the same time, the Speculators (the Leveraged Funds group) have been net short for 9 weeks, position that has also been increasing.

What does this mean? Are we to believe that Dealers are bullish on the market, and the Speculators, on the other hand, do not believe in this rally?

To try to interpret the meaning of these positions, we have done some research and these are the results.

For a better understanding, we have divided this paper into two parts. In the first part we will explain what CFTA is and what COT, Legacy, Disagregated and TFF reports are. In addition, who are the actors involved: Commercial, Non-Commercial, Dealers/Intermediary, Non-Reportable, Swap dealers, Leveraged Funds, and Managed Money. If you do not know much about COT reports, we encourage you to read the first part.

If you have already mastered these concepts, you can go directly to the second part where we will show the results of our research.

Part 1

Who is who, and what is what?

What is the COT?

Futures traders who handle certain volumes are required by law to report their positions on a weekly basis. This is the COT reporting material.

The Commitment of Traders (COT) report is a snapshot of the commitment of classified trading groups through Tuesday of that same week, and is published every Friday by the Commodity Futures Trading Commission (CFTC) at 3:30pm E.T.

The report provides investors with up-to-date information on futures market trading and increases the transparency of these complex exchanges. Many futures traders use it as a market signal on which to trade.

What is the CFTC?

The Commodity Futures Trading Commission (CFTC) is an independent federal agency created in 1974 at a time when most futures trading was in the agricultural sector. It regulates the derivatives markets, including futures, options and swaps contracts, in the United States. Its objectives include promoting competitive and efficient markets and protecting investors against manipulation, abusive trading practices and fraud.

How many COT reports are there?

COT reports cover two main categories:

•Physical commodities

•Financial commodities

In the early days, when most commodity futures belonged to the agricultural sector, there was only the Legacy report, which divided participants into Commercial and Non-Commercial. Commercials were all those who worked with the physical commodity and went to the futures market to hedge their trades. Non-Commercials were speculators who came to the futures market to try to make a profit by buying and selling futures.

In 2009, the CTFC issued a new report, the Disaggregated report, to provide greater transparency of the positions taken by traders and their purpose. It broke down the existing Commercial and Non-Commercial categories into 4 new categories - Producer/Processor, Swap Dealer, Managed Money and Other Reportable.

In 2010 because financial instruments do not have "Producers" or "Processors" like physical commodities, the CFTC published a new type of report to cover these instruments: the Traders in Financial Futures or TFF report. The TFF report includes financial contracts, such as currencies, U.S. Treasury securities, Eurodollars, equities, VIX, and the Bloomberg Commodity Index.

The TIF report also breaks down the classification of Commercial and Non-Commercial into 4 new categories: 1) Dealer/Intermediary, 2) Asset Managers/Institutional, 3) Leveraged Funds and 4) Other Reportable.

What does the TFF report?

The TFF report, like all other COT reports, provides a breakdown of each Tuesday's Open Interest for markets in which 20 or more traders hold positions equal to or above the reporting levels established by the CFTC. This report is published in futures-only and futures-and-options combined formats. The TFF report is published side-by-side with the Legacy COT.

Who are the traders in the different categories?

Legacy report

Commercials: The “Commercial” trader category has always included traders who report that they manage their business risks by hedging in futures. Commercials are the most knowledgeable participants of futures markets, since they are the producers/processors of physical or major hedgers of financial commodities. Their dynamic repositioning often leads to major or interim market tops/bottoms. Everyone else is classified as “Non-Commercial.”

Non-Commercials: Include all the other traders:

Large Speculators, speculators holding many futures (and options) contracts, above a certain limit.

Small Speculators: Speculators holding not too many futures (and options) contracts, below a certain limit.

Disaggregated report

Processors/Users – Processors or users are traders who use the futures markets as a hedge to the physical commodity in the cash market. These traders include producers of the commodity, consume mass quantities of the commodity or trade the commodity in the cash market.

Swap Dealers – Swap dealers, as defined by the CFTC, is “an entity that deals primarily in swaps for a commodity and uses the futures markets to manage or hedge the risk associated with those swaps transactions.” In other words, swap dealers are typically traders who take the other side of trades for hedgers and large speculators. “swap dealers,” who incur risk in the over-thecounter (OTC) derivatives market.

Managed Money – These traders are Commodity Trading Advisors (CTAs), Commodity Pool Operators, or hedge funds that hold large speculative positions in the futures.

Other Reportable – Traders outside of the three categories listed above that have substantial positions, as defined by the CFTC, in a market.

Non-Reportable – Traders outside of the first three categories listed above that have small positions, as defined by the CFTC, in a market.

TFF report

The TFF report divides the financial futures market participants into the “sell side” and “buy side.” This traditional functional division of financial market participants focuses on their respective roles in the broader marketplace, not whether they are buyers or sellers of futures/option contracts.

Dealer/Intermediary. These participants are what are typically described as the “sell side” of the market. Though they may not predominately sell futures, they do design and sell various financial assets to clients. They tend to have matched books or offset their risk across markets and clients. Futures contracts are part of the pricing and balancing of risk associated with the products they sell and their activities. These include large banks (U.S. and non-U.S.) and dealers in securities, swaps and other derivatives. They are not on the market to speculate, their main intention is to hedge their price risk.

The rest of the market comprises the “buy-side,” which is divided into three separate categories:

Asset Manager/Institutional. These are institutional investors, including pension funds, endowments, insurance companies, mutual funds and those portfolio/investment managers whose clients are predominantly institutional.

Leveraged Funds. These are typically hedge funds and various types of money managers, including registered commodity trading advisors (CTAs); registered commodity pool operators (CPOs) or unregistered funds identified by CFTC.3 The strategies may involve taking outright positions or arbitrage within and across markets. The traders may be engaged in managing and conducting proprietary futures trading and trading on behalf of speculative clients.

Other Reportables. Reportable traders that are not placed into one of the first three categories are placed into the “other reportables” category. The traders in this category mostly are using markets to hedge business risk, whether that risk is related to foreign exchange, equities or interest rates. This category includes corporate treasuries, central banks, smaller banks, mortgage originators, credit unions and any other reportable traders not assigned to the other three categories.

NOTE: multi-functional organization that has more than one trading entity may have each trading entity classified separately in a commodity. For example, a financial organization trading in financial futures may have a banking entity whose positions are classified as commercial and have a separate money-management entity whose positions are classified as non-commercial.

What does the TFF report look like?

The COT report as well as the TFF report is a text file with crude data, somehow hard to read and understand if you are not familiar with it.

But, once you become familiar with it, it's easy to locate and understand the data you're looking for. For example, here is the August 2 report on the S&P E-mini Open Interest:

Part 2

The investigation. What we found.

To begin our research, we looked for academic information on how to interpret these reports, but except for a few university theses dealing mainly with agricultural commodities and a couple of monographs, we couldn’t find much.

We checked the media and, apart from a few tutorials that didn't tell us anything new, what we found were scaremongering headlines that only seek to exploit the angle that speculators are short. You may have seen some of these.

Next, we set about looking for historical information. Unfortunately, although the Commission has been around since 1974, it wasn't until 2006 that they started tracking reports. The CTFC website has all the historical data, but it is cumbersome to manage, it is storage of hundreds of text files, one file for each original report.

Most of the historical graphs that exist, due to the format they use, are difficult to interpret. Fortunately we got charts that show more clearly the positions of the participants compared to the SPX.

Let's start with the chart of the Leveraged or Speculative Funds:

Chart showing the positions of Leveraged Funds (Speculators) over the last 16 years

As you can see most of the time this group has been holding net short positions, the largest positions between the years 2010 to 2016, during the great bull market that began in 2009. We also see that at the beginning of the 2020 bull market they increased their short positions. It looks like a display of counter-trading.

We have put together this weekly chart of the SPX in which the shaded area shows the periods in which the Leveraged Funds group has been net short.

This chart reminds us of a Futures Economics class in which it was pointed out that Hedgers went to the Futures market seeking to pay a premium in exchange for protection for the risks arising from their business activity and Speculators were there willing to take on that risk in exchange for a profit.

The risk of these speculator positions must surely be offset by others such as equity portfolios, options, inter-market positions, swaps or anything else.

These charts also tells us how wrong all those Twitter messages, or charts with alarmist headlines from Bloomberg or Bofa are.

We put up together a weekly chart of the SPX showing in shading the occasions when this group was holding net short positions. It’s easy to see how they have been short almost 100% of the time including the big up moves periods.

A big moment was in 2007 when they went short before the financial crisis.

In recent days they went short on December 12, 2021 and in March 15 of this year remaining short until today.

The next chart is for the Dealer/Intermediary group, the Commercials:

Chart showing the Open Interest and net Futures positions of the Dealer/Intermediary group

In 16 years this group has switched to net long positions, also for relatively short periods, remaining short most of the time.

On this weekly chart of the SPX it is easier to see the periods in which the Dealers/Intermediaries group was net long. Of course the rest of the time they were net short.

SPX, weekly chart showing the periods in which the Dealer/Intermediary group has been net long over the past 16 years.

With the exception of 2007, when they were long for two weeks before the great financial crisis, the Dealer/Intermediary group has been long near the beginning of major upward moves.

As we could see both groups stay longer in short positions than in long positions, including periods when the market is in strong rallies.

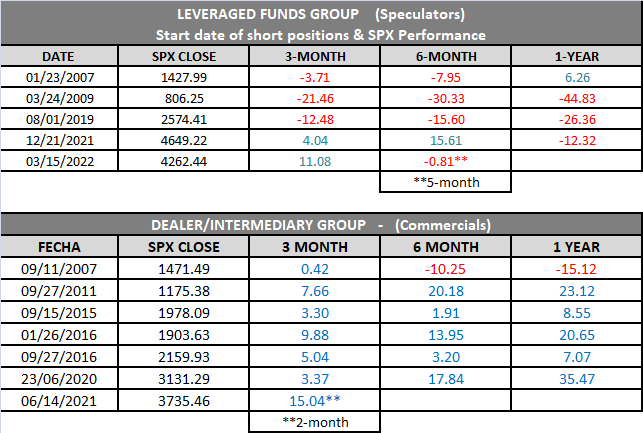

To see how the actions of these players compare, check the two tables below with the SPX returns if every time the Speculators open a short position, a short position is opened and held for one year regardless of whether the group switches to long. The same applies with the Dealers group, if a long position is opened every time they open a long position and held for one year, regardless of whether they switch to short.

Undoubtedly, the result of following the Dealers provides a better result.

There are other ways to compare this data, but this will be the subject of other articles.

Main Take Aways:

The positions taken by Commercials and Speculators who trade financial futures can not be taken directly as bullish or bearish positions.

Dealers and Leveraged Funds stay longer in short positions than in long positions, including periods when the market is in strong rallies.

Dealers are not directional traders, the purchase of futures is determined by the need to offset their usual business risk, for example SPX options traders my need to balance negative deltas they acquired by selling calls or buying puts.

Speculators are probably taking the other side of the trade from Dealers.

The CFTC will not always know with certainty the purpose of the transactions carried out by the various groups.

It's a good idea to go long when Dealers go long.

The data sample is too short to assign much statistical value, but the patterns are repeated.

There is a lot of crap on Twitter

another great research! first time for me to understand all this in detail. bravo!